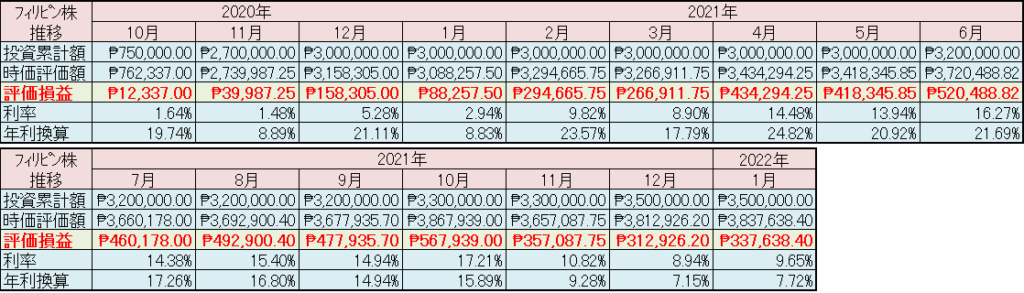

フィリピン株2022年1月末の保有内容

1月末現在で167銘柄3,438,505株を保有し、評価額は3,837,638.40ペソ。元金は3,500,000ペソ。

含益は337,638.40ペソ(配当の合計63,922.78ペソを含む)。運用期間15ヶ月。年利にすると7.72%。2/10から開国するので経済回復を加速してもらいたい!

目指せ利益1,000,000ペソ&毎月配当25000円!

| 銘柄 | 株数 | 単価 | 合計額 |

| 2GOGROUPINC. | 9000 | 7.41 | 66690 |

| ATOKBIGWEDGEMININGCO.INC. | 7000 | 6.13 | 42910 |

| ASIABESTGROUP | 2500 | 5.35 | 13375 |

| ABS-CBNHOLDINGSCORPORATION(PDR) | 3000 | 10.98 | 32940 |

| AYALACORPORATION | 100 | 870 | 87000 |

| ALSONSCONSOLIDATEDRESOURCESINC. | 3000 | 1.01 | 3030 |

| ABOITIZEQUITYVENTURESINC. | 200 | 63 | 12600 |

| ALLIANCEGLOBALINC. | 2500 | 12.8 | 32000 |

| ARTHALANDCORPORATION | 40000 | 0.62 | 24800 |

| ARTHALAND CORPORATION SERIES D PREF SHARES | 100 | 512 | 51200 |

| ANCHORLANDHOLDINGSINC. | 2500 | 6.02 | 15050 |

| AYALALANDINC. | 400 | 35.9 | 14360 |

| ALLDAYMARTSINC. | 10000 | 0.59 | 5900 |

| AGRINURTUREINC. | 4000 | 4.8 | 19200 |

| A.SORIANOCORPORATION | 6200 | 8.2 | 50840 |

| ABOITIZPOWERCORPORATION | 2400 | 35.3 | 84720 |

| APCGROUPINCORPORATED | 30000 | 0.237 | 7110 |

| APOLLOGLOBALCAPITALINC. | 100000 | 0.072 | 7200 |

| ANGLO-PHIL.HOLDINGSCORP. | 10000 | 0.88 | 8800 |

| APEXMININGCOMPANYINC.A | 3000 | 1.66 | 4980 |

| ARANETAPROPERTIESINC. | 24000 | 0.97 | 23280 |

| ASIANTERMINALSINC. | 1200 | 14 | 16800 |

| ASIAUNITEDBANKCORP. | 500 | 44 | 22000 |

| BDOUNIBANKINC. | 500 | 135 | 67500 |

| BELLECORPORATION | 18000 | 1.35 | 24300 |

| BOULEVARDPROP.HOLDINGSINC. | 1400000 | 0.063 | 88200 |

| BRIGHTKINDLERESOURCES&INVESTMENTSINC. | 6000 | 1.92 | 11520 |

| BLOOMBERRYRESORTSCORPORATION | 3000 | 6.27 | 18810 |

| BANKOFPHIL.ISLAND | 300 | 98.1 | 29430 |

| ABROWNCO.INC. | 5000 | 0.76 | 3800 |

| CENTRALAZUCARERADETARLAC | 300 | 12.98 | 3894 |

| CEBUAIRINC. | 100 | 45 | 4500 |

| CROWNEQUITIESINC. | 30000 | 0.104 | 3120 |

| CHINABANKINGCORP. | 200 | 25.45 | 5090 |

| CEMEXHOLDINGSPHILIPPINESINC. | 13000 | 1.05 | 13650 |

| CONCEPCIONINDUSTRIALCORP. | 1000 | 20.2 | 20200 |

| CEBULANDMASTERSINC. | 46830 | 2.91 | 136275.3 |

| CENTURYPACIFICFOODINC. | 200 | 28.3 | 5660 |

| ConvergeInformation&CommunicationsTechSolutions | 1800 | 30.65 | 55170 |

| COALASIAHOLDINGSINC. | 20000 | 0.265 | 5300 |

| COLFINANCIALGROUPINC. | 2000 | 4.1 | 8200 |

| COSCOCAPITALINC. | 5000 | 5.24 | 26200 |

| CENTURYPROPERTIESGROUPINC. | 70000 | 0.41 | 28700 |

| CenturyPeakHoldingsCorporation | 20000 | 2.72 | 54400 |

| CROWNASIACHEMICALSCORP. | 12000 | 1.71 | 20520 |

| CYBERBAYCORPORATION | 20000 | 0.33 | 6600 |

| DOUBLEDRAGONCORPORATION | 7600 | 6.99 | 53124 |

| DDMPREITInc. | 20000 | 1.79 | 35800 |

| DELMONTEPACIFICLIMITED | 5000 | 15.3 | 76500 |

| DITOCMEHoldingsCorporation | 1000 | 5.3 | 5300 |

| DMCIHOLDINGSINC. | 5000 | 8.47 | 42350 |

| D.M.WENCESLAO&ASSOCIATESINC. | 4000 | 6.85 | 27400 |

| D&LINDUSTRIESINC. | 3000 | 8.5 | 25500 |

| EASYCALLCOMMUNICATIONSPHILS. | 500 | 3.98 | 1990 |

| ENGINEERINGEQUIPMENTINC. | 6500 | 6.25 | 40625 |

| EEICorporation Series A Preferred Shares | 500 | 105.1 | 52550 |

| EEICorporation Series B Preferred Shares | 500 | 108 | 54000 |

| EMPIREEASTLANDHOLDINGSINC | 70000 | 0.26 | 18200 |

| EMPERADORINC. | 500 | 23.75 | 11875 |

| EURO-MED.LAB.PHILSINC. | 3000 | 1.42 | 4260 |

| EVER-GOTESCORES.HOLDINGSINC | 100000 | 0.345 | 34500 |

| EASTWESTBANKINGCORPORATION | 5200 | 9.37 | 48724 |

| FILINVESTDEVELOPMENTCORP. | 1500 | 7.39 | 11085 |

| FilinvestREITCorp. | 1000 | 7.61 | 7610 |

| FILINVESTLANDINC. | 28000 | 1.09 | 30520 |

| GLOBALFERRONICKELHOLDINGSINC. | 43000 | 2.16 | 92880 |

| ALLIANCESELECTFOODSINTL.INC. | 40000 | 0.6 | 24000 |

| FIRSTPHIL.HOLDINGS | 400 | 70 | 28000 |

| FruitasHoldingsInc. | 5000 | 1.24 | 6200 |

| GEOGRACERESOURCESPHILS.INC. | 80000 | 0.208 | 16640 |

| GLOBAL-ESTATERESORTSINC. | 5000 | 0.95 | 4750 |

| GLOBETELECOMGMCRINC. | 10 | 3110 | 31100 |

| GINEBRASANMIGUELINC. | 100 | 116 | 11600 |

| GTCAPITALHOLDINGSINC. | 40 | 570 | 22800 |

| HOLCIMPHILS.INC. | 1000 | 5.94 | 5940 |

| ALLHOMECORP. | 700 | 8.52 | 5964 |

| 8990HOLDINGSINC. | 4000 | 11.04 | 44160 |

| GoldenMVHoldingsInc. | 20 | 540 | 10800 |

| INT`L.CONTAINERTERMLSV | 250 | 200 | 50000 |

| IntegratedMicro-ElectronicsInc. | 1000 | 10.4 | 10400 |

| IMPERIALRESOURCESINC. | 3000 | 1.4 | 4200 |

| IONICSCIRCUITSINC. | 5000 | 0.73 | 3650 |

| IPMHOLDINGSINC. | 5000 | 7 | 35000 |

| IRCPROPERTIESINC. | 3000 | 1.06 | 3180 |

| JACKSTONESINC. | 10000 | 1.65 | 16500 |

| JOLLIBEEFOODSCORP. | 120 | 240 | 28800 |

| JGSUMMITHOLDINGSINC. | 105 | 62.5 | 6562.5 |

| THEKEEPERSHOLDINGSINC. | 14910 | 1.46 | 21768.6 |

| KEPPELPHILS.PROPERTIESINC | 1000 | 2.96 | 2960 |

| KEPWEALTHPROPERTYPHILS.INC. | 4000 | 2.82 | 11280 |

| LMGCORP. | 1000 | 3.78 | 3780 |

| PACIFICONLINESYSTEMSCORPORATION | 13000 | 1.77 | 23010 |

| LOPEZHOLDINGSCORPORATION | 2000 | 2.91 | 5820 |

| LEISURE&RESORTSWORLDCORP. | 20000 | 1.4 | 28000 |

| LTGROUPINC. | 3000 | 10 | 30000 |

| MACRO-ASIACORP. | 1000 | 5.4 | 5400 |

| MACAYHOLDINGSINC. | 2000 | 5.51 | 11020 |

| MAXSGROUPINC. | 6000 | 6.7 | 40200 |

| METROPOLITANBANK&TRUSTCO. | 700 | 58.9 | 41230 |

| MEDCOHOLDINGSINC. | 140000 | 0.29 | 40600 |

| MEGAWORLDPROP.&HOLDINGSINC | 1000 | 3.09 | 3090 |

| MANILAELECTRICCO. | 100 | 335 | 33500 |

| MABUHAYHOLDINGSCORPORATION | 10000 | 0.38 | 3800 |

| MANILAJOCKEYCLUB | 4000 | 2.08 | 8320 |

| MONDENISSINCORPORATION | 500 | 16.38 | 8190 |

| METROPACIFICINVESTMENTSCORP | 5000 | 3.85 | 19250 |

| MREITINC. | 1000 | 22.5 | 22500 |

| METRORETAILSTORESGROUPINC. | 6000 | 1.37 | 8220 |

| MANILAWATERCOMPANYINC. | 2000 | 25 | 50000 |

| MEGAWIDECONSTRUCTIONCORPORATION | 7700 | 4.84 | 37268 |

| MEGAWIDECONSTRUCTIONCORPSERIES2APREFSHARES | 500 | 91 | 45500 |

| NOWCORPORATION | 24000 | 1.26 | 30240 |

| NATIONALREINSURANCECORPOFTHEPHILS. | 69000 | 0.66 | 45540 |

| OMICOMINING&INDUSTRIALCORP | 60000 | 0.355 | 21300 |

| ORIENTALPENINSULARESOURCESGROUPINC | 30000 | 0.82 | 24600 |

| PETRONCORP. | 2000 | 3.26 | 6520 |

| PETROENERGYRESOURCESCORP. | 12000 | 4.3 | 51600 |

| PUREGOLDPRICECLUBINC. | 400 | 37.1 | 14840 |

| PHIL.ESTATESCORP. | 20000 | 0.47 | 9400 |

| PHINMACORPORATION | 3000 | 20.95 | 62850 |

| PHRESORTSGROUPHOLDINGSINC. | 7000 | 0.74 | 5180 |

| SHAKEYSPIZZAASIAVENTURESINC. | 600 | 9.42 | 5652 |

| PREMIUMLEISURECORP. | 130000 | 0.45 | 58500 |

| PHIL.NATIONALBANK | 3000 | 20.5 | 61500 |

| PRYCEPROPERTIES | 7000 | 5.74 | 40180 |

| PHILRACINGCLUBINC. | 5000 | 5 | 25000 |

| PRIMEXCORPORATION | 18000 | 2.12 | 38160 |

| PHIL.SAVINGSBANK | 30 | 57.7 | 1731 |

| PXPENERGYCORPORATION | 300 | 5.95 | 1785 |

| ROXASANDCOMPANYINC. | 19000 | 0.68 | 12920 |

| RLCOMMERCIALREITINC. | 2000 | 8.4 | 16800 |

| RFMCORP. | 5000 | 4.55 | 22750 |

| ROBINSONSLANDCORPORATION | 500 | 18.3 | 9150 |

| PHIL.REALTY&HOLDINGSCORP. | 10000 | 0.21 | 2100 |

| ROCKWELLLANDCORPORATION | 3000 | 1.5 | 4500 |

| ROXASHOLDINGSINC.(CENTRALAZUCARERA) | 11000 | 1 | 11000 |

| ROBINSONSRETAILHOLDINGSINC. | 550 | 56.4 | 31020 |

| SEMIRARAMININGANDPOWERCORPORATION | 2400 | 25.05 | 60120 |

| SECURITYBANKCORP. | 50 | 107.2 | 5360 |

| PHILIPPINESEVENCORP. | 200 | 88 | 17600 |

| SWIFTFOODSINC. | 30000 | 0.105 | 3150 |

| SOLIDGROUPINC. | 5000 | 1.16 | 5800 |

| PILIPINASSHELLPETROLEUMCORP. | 500 | 19.02 | 9510 |

| SHANGPROPERTIESINC. | 8000 | 2.59 | 20720 |

| STALUCIALANDINC | 3000 | 2.89 | 8670 |

| SMINVESTMENTSCORPORATION | 10 | 949 | 9490 |

| SMCSeries2 Preferred Shares?Subseries2-J | 700 | 76.5 | 53550 |

| SOCResourcesInc. | 7000 | 0.57 | 3990 |

| SALCONPOWERCORPORATION | 400 | 14.3 | 5720 |

| SSIGROUPINC. | 3000 | 1.09 | 3270 |

| SFASEMICONPHILIPPINESCORP. | 3000 | 1.1 | 3300 |

| STIEducationSystemsHoldingsInc. | 10000 | 0.335 | 3350 |

| VistamallsInc. | 1000 | 3.6 | 3600 |

| SUNTRUSTHOMEDEVELOPERSINC. | 4000 | 1.07 | 4280 |

| TKCMETALSCORPORATION | 25000 | 0.8 | 20000 |

| CIRTEKHOLDINGSPHILS.CORPORATION | 2000 | 3.86 | 7720 |

| PLDTINC. | 10 | 1834 | 18340 |

| TOPFRONTIERINVESTMENTHOLDINGSINC. | 40 | 125 | 5000 |

| HARBORSTARSHIPPINGSERVICESINC. | 4000 | 0.81 | 3240 |

| UNIVERSALROBINACORP. | 30 | 127 | 3810 |

| VITARICHCORPORATION | 6000 | 0.68 | 4080 |

| VISTALANDANDLIFESCAPESINC. | 11000 | 3.48 | 38280 |

| VICTORIASMILLINGCO.INC. | 2000 | 2.4 | 4800 |

| VULCANMINING | 20000 | 0.82 | 16400 |

| PHILWEB.COMINC. | 5000 | 1.96 | 9800 |

| ZEUSHOLDINGSINC. | 190000 | 0.17 | 32300 |